Across the EMEA glass industry, a fundamental shift is underway.

The traditional, gas-fired furnaces that have defined glassmaking for more than a century are being redesigned, rebuilt or replaced to meet the demands of a low-carbon future. The changes are no longer at the edges of the industry. They are now central to capital strategy, R&D investment, customer expectations, and the skills and capabilities required of the workforce leaders.

In this article, I talk about what is happening in furnace decarbonisation, why it is happening, what it means for the industry, and what it means for talent.

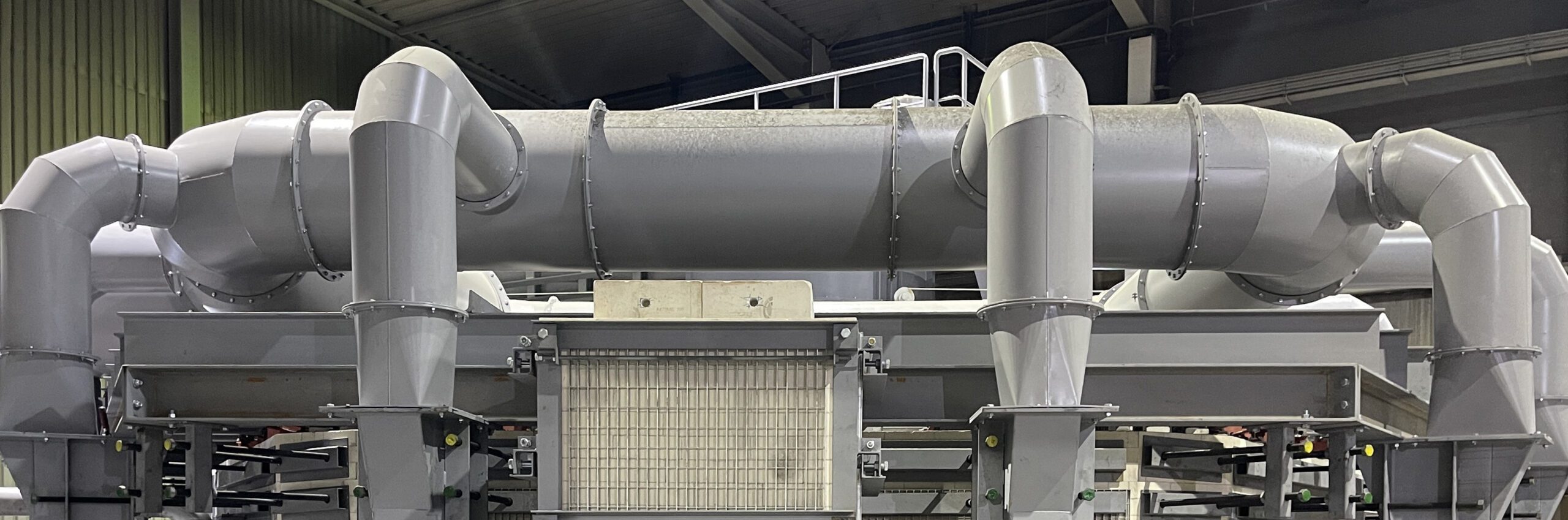

The Move to Electric Furnaces

A major shift in the EMEA glass industry is the move towards hybrid-electric and fully electric furnaces, blending renewable electricity with conventional energy.

- Hrastnik1860’s BEAR project, for example, will use up to 40% electricity (compared with 5–10% in traditional boosting).

- O-I is retrofitting a furnace in Veauche, France, with a hybrid-flex system running 30–70% on electricity, aiming to cut CO₂ emissions by 43%.

- Heinz-Glas has installed a fully electric furnace in Piesau.

- Schott is building a €40 million electric melting tank in Germany to reduce emissions for its pharmaceutical glass by up to 50%.

These developments are supported by complementary strategies including hybrid-electric furnaces, hydrogen and biofuel combustion, oxy-fuel technology and higher cullet content.

What’s Driving the Change?

The shift towards hybrid-electric and fully electric furnaces is driven by a mix of regulatory, technological, economic and market pressures reshaping investment and operations.

- Regulatory and environmental imperatives: Governments across Europe are tightening emissions rules, and rising carbon costs, along with reputational risk, are pushing glassmakers to rethink processes.

- Technology is maturing: Glassmaking requires very high temperatures and has historically relied on fossil gas. Electric melting, hybrid systems and alternative fuels are now moving from lab-scale trials to industrial deployment.

- Circular economy and resource optimisation: Using more cullet not only supports sustainability but reduces energy use. Combining higher cullet rates with electrification is a highly effective decarbonisation strategy.

- Financial incentives and public funding: Projects such as Hrastnik’s BEAR furnace have benefited from EU Innovation Fund co-funding. Public support, together with ESG commitments, helps de-risk these major capital investments.

- Market demand: Customers, particularly in premium and pharmaceutical segments, increasingly demand low-carbon packaging. Schott’s decarbonised tubing for vials, syringes and ampoules illustrates this trend.

What the Move to Electric Furnaces Means for the Industry

For manufacturers, this period represents both opportunity and complexity. Early adopters are positioning themselves as leaders in low-carbon glass, a distinction that may soon carry commercial advantages as buyers look beyond price to emissions credentials.

However, the strategic decisions are far from straightforward, as furnace overhauls are expensive and must be timed with cold repairs, meaning companies need to plan years ahead. Retrofits and hybrid systems offer a pragmatic route forward, allowing firms to blend gas, electricity and alternative fuels as infrastructure develops.

Infrastructure is one of the most significant challenges. The electrification of melting demands significant grid capacity and a stable supply of renewable power – which is not a given in every region. Electricity availability could become a bottleneck in scaling electric furnaces, which may push manufacturers to form regional partnerships or position facilities near renewable clusters and hydrogen hubs.

In the long term, the industry may fragment into differentiated value propositions. Some producers might lead with fully electrified “green glass”, others with hydrogen-compatible furnaces or high-cullet circular systems.

The technology mix is unlikely to consolidate quickly. Instead, the sector appears set for a period of experimentation, portfolio strategies and incremental scaling.

Decarbonisation’s Impact on Leadership Requirements

Decarbonisation is reshaping the leadership landscape in the EMEA glass industry. Executives and senior leaders must now balance long-term strategic investment with operational realities, navigating complex decisions about electrification, hybrid technologies and alternative fuels. Leading these transformations requires a blend of technical literacy, commercial acumen and strategic foresight.

Senior leaders also play a critical role in bridging functional silos. Decisions around furnace retrofits, energy sourcing and circular economy initiatives involve R&D, operations, finance and sustainability teams, meaning executives must excel at cross-disciplinary collaboration and stakeholder management.

The drive toward decarbonisation also elevates the importance of ESG and sustainability leadership. Companies are increasingly seeking executives who can translate ambitious carbon-reduction targets into actionable business strategies while engaging investors, regulators and key clients.

Finally, leadership talent must cultivate a culture of innovation and change. Transforming century-old manufacturing processes requires influencing organisational behaviour, fostering agility and building the internal capabilities to adopt new technologies.

Those who can navigate this intersection of technology, strategy and people will define which companies emerge as leaders in a low-carbon glass industry.

Conclusion

Decarbonisation in the EMEA glass industry – and especially in furnace technology – represents a full-blown strategic shift. Hrastnik’s BEAR hybrid furnace, Schott’s all-electric tank, and O-I’s hybrid-flex furnaces all signal that established players are investing significantly in clean-tech.

For the industry, this means rebalancing CAPEX, pioneering new business models and building circular systems around recycled glass. For senior talent, it represents a unique opportunity to shape the future of glassmaking, lead major transformation projects, and build expertise in low-carbon technologies.

Glassmakers that align their decarbonisation roadmap with infrastructure, talent and customer demand may well emerge as the leaders of a low-carbon glass economy – shaping not just what the future looks like, but how it’s built.

–

Julia Murphy | Associate Partner | Industrials | EMEA

E: julia.murphy@weareprocogroup.com | T: +44 12 7303 2695