A recent report from the Mexican National Autoparts Industry (INA) forecasted that Mexico’s auto parts production market will generate $126bn in revenue by the end of the year

– a feat that they say is historic to the country.

As Chris Powell, Proco Group’s CEO, said in his recent article, nearshoring has the potential to significantly bolster Mexico’s economy. With foreign direct investment (FDI) continuously increasing, it’s apparent that the country has grabbed the opportunity by its horns.

One industry that’s truly thriving as a result of the surge in companies nearshoring in Mexico is the automotive industry. However, this relatively new opportunity brings with it new challenges that companies must overcome to succeed.

In this article we share the impact of nearshoring in Mexico’s automotive industry, as well as the key challenges it presents and how to navigate them successfully.

Growth and diversification across Mexico’s automotive industry

With the prediction that Mexico will become the fifth-largest global vehicle producer by 2025, it’s clear that the country’s automotive industry is excelling as a result of the ever-growing presence of nearshoring. In the first quarter of the year alone, auto parts production created a total of £31bn in revenue – 8% more than the same time period of the previous year.

As well as boosting the economy, in recent years nearshoring has also diversified Mexico’s automotive industry – both in terms of locations and production lines.

Whilst traditionally, certain states within Mexico have specialised in the automotive industry, at the start of the year we saw a shift, with new states leading the growth. According to Armando Cortés Galicia, INA’s general director, 5 new states contributed significantly to the growth of auto parts production in the first quarter of 2024:

- Yucatán, 52% growth

- Zacatecas, 19.7% growth

- San Luis Potosí, 15.8% growth

- Durango, 14.1% growth

- Guanajuato, 13.5% growth

Additionally, Mexico witnessed diversification of the production lines within the automotive industry, with electrical parts accounting for 19.42% of total production. This demonstrates the diversity of Mexico’s automotive industry, with everything from transmissions and clutches to fabrics, carpets, and seats, highlighting how dynamic the sector is. Reflecting on this at a recent press conference, Armando Cortés Galicia said it:

"reflects the constant evolution and adaptation of the auto parts industry to meet the demands of the global market."

Nearshoring in Mexico’s automotive industry: key players

Between 2006 and November 2023, nearshoring in Mexico’s automotive industry brought with it FDI from 815 companies across 35 countries.

BMW have invested €800 million into a new high-voltage battery production site in San Luis Potosí, generating approximately 1,000 new jobs in the region. Alongside BMW, a significant number of established automakers have also made the move, including:

- Audi

- Ford

- Hyundai

- Mercedes-Benz

- Volkswagen

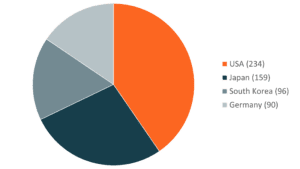

In terms of geographical split, the international companies that are leading nearshoring efforts in Mexico include:

Interest in nearshoring in Mexico’s automotive industry is only set to increase, with 2024 State of Manufacturing Report highlighting an increase in leaders looking to nearshore (48% in 2022, compared to 55% in 2024).

Whilst there are a number of significant benefits to nearshoring in Mexico’s automotive industry, companies that have done so are already witnessing an increase in costs – both in terms of land and wages.

And, as more companies set up operations in Mexico, competition for talent is also set to become more apparent.

The challenge of entering an already competitive talent landscape

A recent report found that 76% of automotive employers are struggling to find qualified talent.

Further to this, although the automotive industry is enjoying the diversification of their product lines, the introduction of more electrical parts brings with it new skill requirements – something that many of the existing workforce do not have.

Whilst the country is launching new initiatives to upskill the workforce, including proactively adapting education to meet sector needs and strengthening industry-education partnerships, there is a significant gap that needs to be filled – for example, to meet the talent requirements of the existing automotive industry, Mexico needs an additional 20,000 engineers.

With new technologies and processes being introduced to the automotive industry, the talent gap extends across the full spectrum of roles required, from engineers to executives.

Whilst upskilling will go some way to address these gaps in the long-term, an immediate shift in hiring strategy is required for companies to attract and retain the best talent in this increasingly competitive landscape. This is especially true at executive and leadership level – something that we are increasingly supporting more clients with.

Navigating nearshoring in Mexico’s automotive industry, and the war on talent

As companies begin to evolve their approach to hiring, compensation and benefits, offering incentives like increased flexibility, salary increases and new wellbeing initiatives, the war on talent is only set to increase.

To execute a successful hiring strategy, it’s critical to truly understand the talent landscape of Mexico’s automotive industry.

Proco Group’s dedicated Industrials team has been partnering with companies that are setting up operations in Mexico to source, attract and retain sought-after individuals. Through comprehensive benchmarking and competitor analysis, we deliver an extensive map of what’s going on in the market for critical roles. Using the analysis, we source exceptional, sought-after talent from our network to fill these roles.

In the past two years, we’ve helped companies that are nearshoring in Mexico to several roles with in-demand candidates, including:

- Plant Manager

- Supply Chain Manager

- PC&L Manager

- Engineering Director

- Engineering VP & Electrification VP

- Operations Manager

- Purchasing Director

- Finance Director & HR Director

–

For a conversation with a member of our dedicated team about nearshoring in Mexico and its associated talent requirements, please get in contact via the details below:

Kurt Pohle: Associate Partner | Industrial Markets | NORAM

T: +1 646 902 9051 E: kurt.pohle@weareprocogroup.com

Sebastián González: Principal | Industrial Markets | LATAM

T: +52 55 4124 0433 E: sebastian.gonzalez@weareprocogroup.com